The Silent Revolution: How JPMorgan’s COIN Is Rewriting Banking’s Back Office

When most people think of wealth management, their minds jump to portfolio dashboards, sharp-suited advisors, and glossy client apps. But behind that polished surface lies the unglamorous machinery of finance: contracts that run into hundreds of pages, compliance checks that can derail deals, and audits that consume time and manpower. For decades, this “back office” has been the bottleneck of banking. JPMorgan Chase, however, is quietly changing that story.

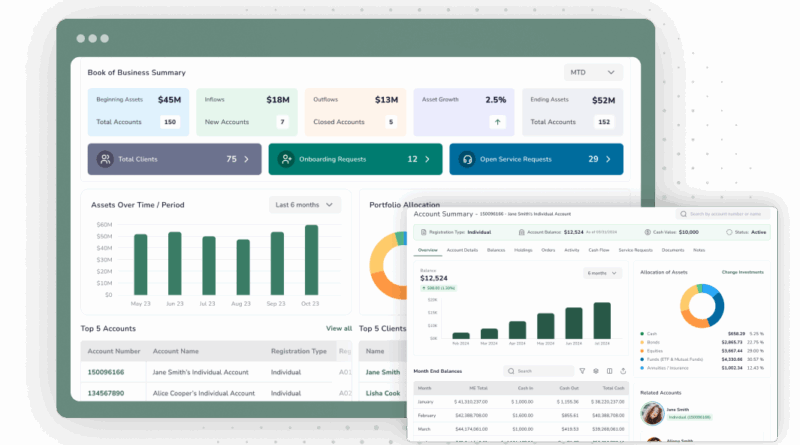

The engine of this shift is COIN—Contract Intelligence, a proprietary AI system that reads and interprets legal documents at machine speed. What once required armies of analysts poring over fine print now takes hours instead of weeks. The system doesn’t just scan words; it understands context, highlights risk, and ensures compliance with the kind of accuracy that minimizes costly human error.

For clients, the impact is tangible. Onboarding becomes faster—what once took weeks of legal back-and-forth can be streamlined into a matter of days. Processes become cleaner—redundancies and misinterpretations are reduced. Most importantly, confidence rises. Clients can trust that their money, transactions, and contracts won’t get tripped up in the maze of regulatory missteps. In high-stakes global finance, that assurance is invaluable.

COIN is also emblematic of a bigger shift: the automation of invisible but essential layers of banking. While robo-advisors and mobile apps get the spotlight, the real transformation is happening where clients rarely look. By freeing human experts from repetitive, rules-based tasks, JPMorgan ensures that their focus returns to strategy, relationships, and innovation—the places where human judgment truly adds value.

This isn’t about replacing bankers with bots. It’s about augmenting human expertise with AI precision, ensuring that a $3 trillion bank runs as smoothly behind the curtain as it does in the spotlight.

In an era where speed and compliance define competitiveness, JPMorgan’s COIN is not just a tool—it’s a blueprint. A reminder that the future of wealth management won’t be won in front-facing apps alone, but in the quiet, efficient revolutions that happen behind the scenes.

Info Box: JPMorgan’s COIN in Numbers

- 360,000 hours saved annually in contract review.

- 90%+ accuracy in compliance checks.

- Cutting review time from weeks to hours.